sales tax on leased cars in illinois

Write the result on Line 4. So in your scenario you have about 200 in sales tax on the trade and 30mo for the payment.

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

If the down payment is 2000 the tax on that would be 165.

. On average the total Illinois car sales tax is 8154. However the total tax rate is dependent on your county and local taxes which can be up to 115. First division motor vehicles and.

With the new next law Countryside drivers will pay an additional 341250 in taxes with a tax rate of 975. The changes are effective January 1 2015. Use the illinois tax rate finder to find your tax.

The tax is imposed on motor vehicles purchased or acquired by gift or transfer from another individual or private party. Sales tax is a part of buying and leasing cars in states that charge it. Find Your 2021 Nissan Now.

With the Illinois tax law a new sales tax gets applied to a trade-in value above 10000. Vehicle sales tax for vehicles sold by a dealer usually 625 but can vary by location. As a retailer the lessor must collect tax on each periodic payment the lessee makes under the conditional sales agreement.

Sales tax and use tax consequences of leasing equipment in Illinois. This combined rate is also preprinted on your ST-556 return below Line 4. For vehicles that are being rented or leased see see taxation of leases and rentals.

With the new Illinois tax law a sales new tax will be applied to a trade-in value above 10000. The total tax for a 36-month lease would be 1056 or 1419 less than under the current formula. If you claim that the sale is.

In Illinois you will pay monthly taxes as of January 1 2015 see Illinois Car Lease Tax. If the tax for the purchase has not already been reported on Form ST-556 or Form ST-556-LSE then the individual or business purchasing the item must file Form RUT-25 Vehicle Use Tax Transaction Return or in the case of a purchase for lease Form RUT-25-LSE Use Tax Return for Lease Transactions to report the transaction. Like with any purchase the rules on when and how much sales tax youll pay when you lease a car vary by state.

If the monthly payment is 300 the sales tax would be 2475 each month. For example if you trade-in your current Volkswagen and receive a trade-in value of 10000 and then you buy a new car for 45000 youll pay a sales tax on the remaining 35000. With the new tax law Countryside drivers will be paying.

Illinois Car Lease Tax Car leasing in Illinois will become much less expensive on January 1 2015 due to changes in the applicable tax law. For vehicles that are being rented or leased see see taxation of leases and rentals. Illinois collects a 725 state sales tax rate on the purchase of all vehicles.

Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. Previously taxes were based on the full value of a leased vehicle even though the leasing customer never received full use of the vehicle. If you want to stay within budget checking the ticket price of the car youre shopping for isnt enough.

The vast majority of cars in the United States and Canada for that matter are equipped with automatic transmission - manual stick shift cars are very much the exception to the rule. If the down payment is 2000 the tax on that would be 165. If you are in Chicago it is 95 this is separate from the Chicago lease tax.

The purported lease to nominal lessee can be subject to the retailers occupation tax. Sales of motor vehicles from registered Illinois dealers are taxed under the Retailers Occupation Tax Act Tax Rate Use the Use Tax Rate Table in the Tax Rate Database to determine your tax liability. To figure the correct tax due add 125 0125 to your rate preprinted in Section 6 on Line 4 and multiply the combined rate by the amount subject to tax on Line 3.

Whether the car is purchased used or new. Illinois law has changed so that sales tax applies to the down payment and monthly lease payments. 1 the Illinois law will change so that sales tax applies to the down payment and monthly lease payments.

If the monthly payment is 300 the sales tax would be 2475 each month. Nows The Time To Save Big On Nissans Award Winning Lineup. This post provides an overview of the retailers occupation tax ie.

In addition to state and county tax the City of Chicago has a 125 sales tax. In the state of Illinois any rentals for a maximum of one year will be subject to an automobile renting occupation and use tax. Money down and trades plus your monthly payment.

What is a lease. All car sales in Illinois are subject to a state sales tax rate of 625. In addition to state and county tax the city of chicago has a 125 sales tax.

If you trade-in your car and get 10000 for it and purchase a new car for 45000 youll pay a sales tax on the remaining 35000. Under Illinois law true leases and conditional sales often referred to as 1 outs are subject to different tax treatment. Illinois taxes you on any rebates and cap cost reductions ie.

Ad Build Price Locate A Dealer In Your Area. According to the Sales Tax Handbook because vehicle purchases are prominent in Illinois they may come with substantial taxes. The alternate selling price eg the amount due at lease signing plus the total amount of payments over the term of the lease must be used when a qualifying motor vehicle is sold for the purpose of being leased under a fixed-term lease contract for a period of more than one year.

There is also between a 025 and 075 when it comes to county tax. Tangible Media Property EXEMPT In the state of Illinois lessors are required to pay a use tax upon acquisition. Illinois collects a 725 state sales tax rate on the purchase of all vehicles.

So your total payment is 335mo 20036 30 300. When lessors lease vehicles for a term longer than one year they owe use tax up front on the selling price of the vehicle. In illinois you will pay monthly taxes as of january 1 2015 see illinois car lease tax.

Qualifying motor vehicles are. Public Act 98-628 amends the Retailers Occupation Tax Act and the Use Tax Act to provide for an alternate method of determining the selling price subject to sales and use taxes for certain motor vehicles sold for the purposes of being leased. When you choose to lease a car in Illinois youll pay sales tax on the cost of your new or used car the key factor is that youll only owe tax on the part of the car you lease your monthly payment rather than on the total value of the vehicle.

The Benefits Of Buying Off Lease Cars Carfax

Learn More About Enterprise Certified Used Cars Enterprise Rent A Car

Leasing Fees Explained In Detail Everything You Need To Know Capital Motor Cars

Why Car Leasing Is Popular In California

How Do I Sell My Leased Car To A Third Party

12 Tips For Negotiating A Car Lease U S News

The Fees And Taxes Involved In Car Leasing Complete Guide

Buy A Car Vs Lease A Car Difference And Comparison Diffen

Car Financing Are Taxes And Fees Included Autotrader

1976 Lancia Advertising Road Track April 1976 Old Ads Car Advertising Advertising

Illinois Car Sales Tax Countryside Autobarn Volkswagen

Cars Used Cars New Cars Latest Car Gari Prices And News Auto Deals Autodeals Used Cars New Cars Sell Car

Don T Return Your Leased Car Sell It Chicago Sun Times

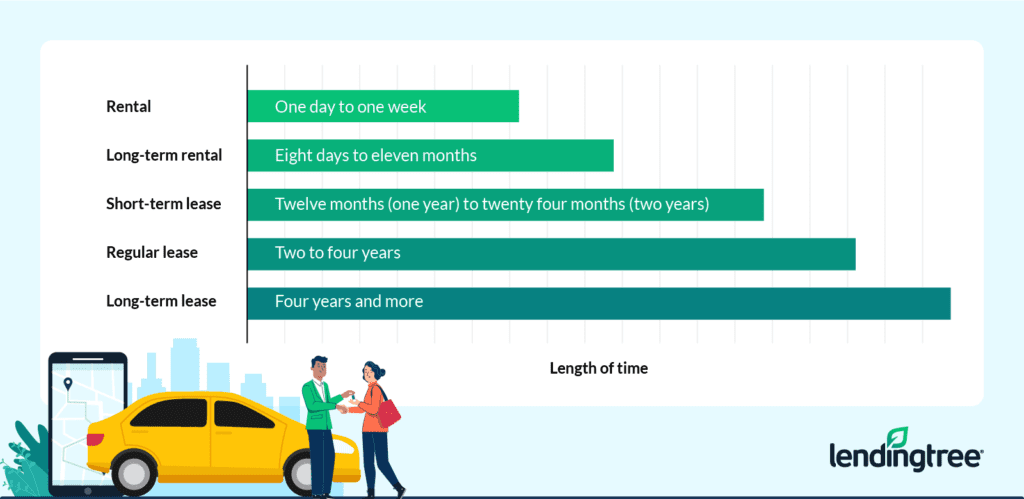

Short Term Car Leases Vs Long Term Car Rentals Lendingtree

How To Buy Or Lease An Electric Car Advice From Owner Who S Done It Four Times

Car Accidents With Leased Cars Adam Kutner Attorneys

/Short-Term_Car_Lease_GettyImages-1152293815-559b180c09644bb2985f5516d2a6a101.jpg)